At the heart of FXKNOWS is our proprietary rating model, designed to deliver a comprehensive evaluation of trading platforms across several key dimensions

Get the Latest Updates of FXKNOWS, Help Customers Better Understand FXKNOWS

This project aims to reduce cross-border payment costs and improve settlement efficiency through blockchain technology, and to establish regional compliance standards, laying the foundation for digital financial integration in Asia.

The U.S. Securities and Exchange Commission (SEC) is considering relaxing disclosure and custody standards for institutional investors holding crypto assets, signifying a shift in regulatory attitude from "restriction" to "guidance."

Traditional asset management giants such as BlackRock and Fidelity have become major buyers, marking a shift in crypto assets from retail speculation to institutional allocation, and ushering in a new institutionalized phase for global digital finance.

Japan's Financial Services Agency (FSA) has approved the JPY Token (JPYT), a fiat-backed stablecoin issued by Sumitomo Mitsui Trust Bank, marking Japan as the first major economy in Asia to allow banks to issue stablecoins. The project is pegged 1:1 to the Japanese yen and is fully regulated by the FSA, signifying the traditional banking system's full entry into the digital currency era.

The European Parliament formally adopted the implementation rules for the Crypto Asset Markets Act (MiCA) | The world's most systematic crypto regulatory framework is now in place.

This project aims to reduce cross-border payment costs and improve settlement efficiency through blockchain technology, and to establish regional compliance standards, laying the foundation for digital financial integration in Asia.

The U.S. Securities and Exchange Commission (SEC) is considering relaxing disclosure and custody standards for institutional investors holding crypto assets, signifying a shift in regulatory attitude from "restriction" to "guidance."

Traditional asset management giants such as BlackRock and Fidelity have become major buyers, marking a shift in crypto assets from retail speculation to institutional allocation, and ushering in a new institutionalized phase for global digital finance.

Gain real-time insights into deeper risks and enjoy a wealth of premium value

Our carefully selected industry experts each bring a wealth of pertinent experience and research

Jeffrey Edward Gundlach (born October 30, 1959) is an American investor and philanthropist. He founded DoubleLine Capital in 2009 after leading the TCW Total Return Bond Fund. He is often called “the Bond King” by the financial media for his influence on the fixed-income market.

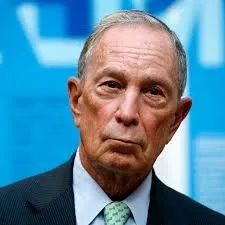

Michael Rubens Bloomberg (born February 14, 1942) is an American businessman, politician, philanthropist, and co-founder of Bloomberg L.P., a global financial data and media company. He served three terms as the Mayor of New York City (2002-2013) and is known for his data-driven approach to governance and urban innovation. He holds degrees from Johns Hopkins University and Harvard Business School.

Elon Reeve Musk (born June 28, 1971) is a South African-born American entrepreneur and inventor. He founded SpaceX, co-founded Tesla, Neuralink, and The Boring Company, and is one of the world’s most influential technology figures. Musk is known for pioneering reusable rockets and advancing AI and sustainable transport.

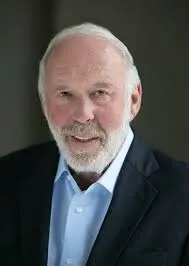

James Harris Simons (born April 25, 1938) is an American mathematician and hedge-fund manager. He founded Renaissance Technologies, a pioneering quantitative hedge fund famed for its Medallion Fund’s exceptional returns. He previously chaired the math department at Stony Brook

We integrate major financial regulators, enabling users to quickly verify authentic licensing status and mitigate risks.

We have many partners who are worthy of your trust

You are visiting the FXKNOWS website. FXKNOWS Internet and its mobile products are an enterprise information searching tool for global users. When using FXKNOWS products, users should

consciously abide by the relevant laws and regulations of the country and region where they are located.

License or other information error corrections, please send the information to:info@FXKNOWS.com

Cooperation:info@FXKNOWS.com

The Database of FXKNOWS comes from the official regulatory authorities , such as the FCA, ASIC, etc. The published content is also based on fairness, objectivity and fact. FXKNOWS doesn't ask for PR fees, advertising fees, ranking fees, data cleaning fees and other illogical fees. FXKNOWS will do its utmost to maintain the consistency and synchronization of database with authoritative data sources such as regulatory authorities, but does not guarantee the data to be up to date consistently.

Given the complexity of forex industry, some brokers are issued legal licenses by cheating regulation institutes. If the data published by FXKNOWS are not in accordance with the fact, please click 'Complaints 'and 'Correction' to inform us. We will check immediately and release the results.

Foreign exchange, precious metals and over-the-counter (OTC) contracts are leveraged products, which have high risks and may lead to losses of your investment principal. Please invest rationally.

Special Note, the content of the FXKNOWS site is for information purposes only and should not be construed as investment advice. The Forex broker is chosen by the client. The client understands and takes into account all risks arising with Forex trading is not relevant with FXKNOWS, the client should bear full responsibility for their consequences.

Login means you agree Term of service, Privacy Policy

Registration is automatically completed as successful first login.